The Basics of CFD Trading: How It Works and What You Should Know

The Basics of CFD Trading: How It Works and What You Should Know

Blog Article

CFD Trading: A Complete Guide to Getting Started

Agreement for Huge difference (CFD) trading offers investors a distinctive way to deal financial markets without owning the main asset. It has obtained recognition because of its flexibility and possibility of large earnings, but like any trading process, it requires skill and information to succeed. Whether you're a novice or seeking to refine your strategy, here are a few specialist methods and techniques to assist you make the most of cfds.

1. Realize the Essentials of CFD Trading

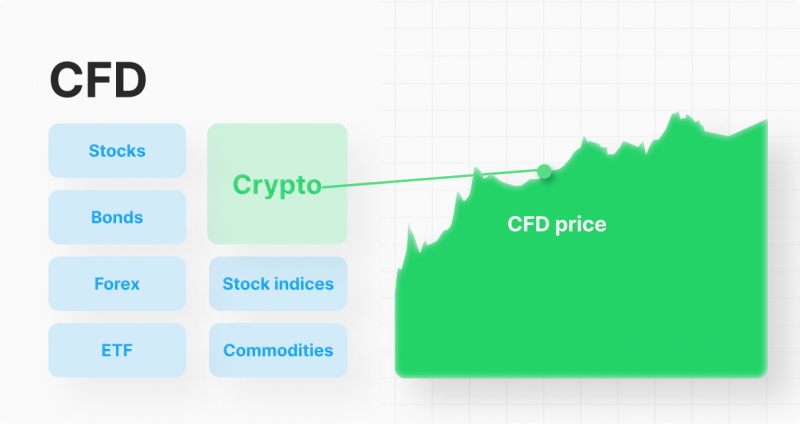

CFD trading enables you to speculate on the cost motion of resources such as for instance stocks, commodities, forex, and indices. Whenever you enter a CFD industry, you're accepting to switch the big difference in the price tag on a property between the full time you open and shut the contract. This means you can profit from equally growing and falling markets.

Before leaping in, it's essential to really have a solid understanding of how CFDs perform, along with the associated risks. Take some time to familiarize yourself with essential terms and concepts such as for example spread, margin, and contract sizes to make educated trading decisions.

2. Employ Flexible Influence Correctly

One of the very most desirable features of CFD trading is variable control, which allows traders to control larger positions with an inferior money outlay. Nevertheless, while influence can amplify gains, it also magnifies potential losses. Use power cautiously and ensure you're confident with the level of risk it introduces in to your trading.

3. Create a Chance Management Technique

A good risk management approach is vital in CFD trading. Always collection stop-loss requests to restrict possible deficits and defend your capital. Also, define the quantity of capital you are ready to risk per deal and adhere to it. Never chance significantly more than you can afford to reduce, as trading inherently provides some level of risk.

4. Remain Updated with Market News

CFD prices are highly inspired by market media and international events. Keeping updated on financial studies, geopolitical developments, and industry sentiment may help you assume price movements. Use trusted news options and consider integrating elementary examination in to your trading strategy to produce better-informed decisions.

5. Choose the Correct Markets to Deal

CFD trading provides a wide variety of markets to trade, but not totally all markets may match your trading style. Some markets are more risky, giving higher possible gains but also better risks. Others tend to be more stable, that might match risk-averse traders. Assess the market conditions and choose those that align along with your chance tolerance and strategy.

Realization

CFD trading could be a rewarding knowledge when approached with knowledge and strategy. By knowledge the basics, applying leverage responsibly, handling chance, and staying educated, you are able to boost your chances of success. Remember, trading is a ability that increases as time passes and experience, so have patience and continue learning as you go. Report this page